Goffstown Nh Tax Rate . For tax exemption & credits information please visit the assessing page. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. the average property tax rate in new hampshire is 19.27. goffstown, nh 03045. property tax exemptions & credits. The first tax bill is mailed at the end of may or early june and is due 30 days. the 2023 census estimate for goffstown was 18,529 residents, which ranked 14th among new hampshire's incorporated cities and. the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. The higher the property tax rate means it’s more expensive to live in that town because property taxes are.

from ceupgijk.blob.core.windows.net

For tax exemption & credits information please visit the assessing page. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. The higher the property tax rate means it’s more expensive to live in that town because property taxes are. the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. the average property tax rate in new hampshire is 19.27. The first tax bill is mailed at the end of may or early june and is due 30 days. the 2023 census estimate for goffstown was 18,529 residents, which ranked 14th among new hampshire's incorporated cities and. goffstown, nh 03045. property tax exemptions & credits.

New Hampshire Property Tax Rates 2020 at Maud Keen blog

Goffstown Nh Tax Rate the 2023 census estimate for goffstown was 18,529 residents, which ranked 14th among new hampshire's incorporated cities and. The first tax bill is mailed at the end of may or early june and is due 30 days. property tax exemptions & credits. the average property tax rate in new hampshire is 19.27. For tax exemption & credits information please visit the assessing page. the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. The higher the property tax rate means it’s more expensive to live in that town because property taxes are. the 2023 census estimate for goffstown was 18,529 residents, which ranked 14th among new hampshire's incorporated cities and. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. goffstown, nh 03045.

From sebrinafranks.blogspot.com

nh bonus tax calculator Sebrina Franks Goffstown Nh Tax Rate goffstown, nh 03045. The first tax bill is mailed at the end of may or early june and is due 30 days. the average property tax rate in new hampshire is 19.27. the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. property tax exemptions &. Goffstown Nh Tax Rate.

From www.neilsberg.com

Goffstown, New Hampshire Median Household By Race 2024 Update Neilsberg Goffstown Nh Tax Rate the average property tax rate in new hampshire is 19.27. For tax exemption & credits information please visit the assessing page. The higher the property tax rate means it’s more expensive to live in that town because property taxes are. property tax exemptions & credits. before the second installment property tax bill is mailed, the department of. Goffstown Nh Tax Rate.

From www.city-data.com

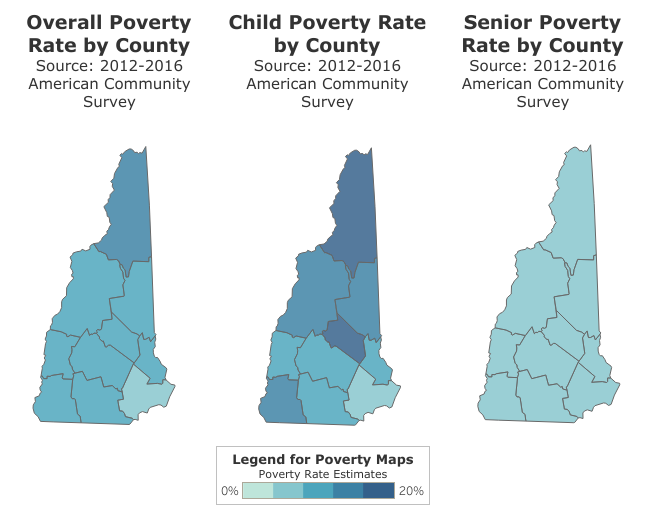

Goffstown, New Hampshire (NH) poverty rate data information about poor and Goffstown Nh Tax Rate property tax exemptions & credits. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. the 2023 census estimate for goffstown was 18,529 residents, which ranked 14th among new hampshire's incorporated cities and. the tax collector’s office is responsible for collecting warranted tax revenue for. Goffstown Nh Tax Rate.

From www.neilsberg.com

Goffstown, New Hampshire Population by Year 2023 Statistics, Facts & Trends Neilsberg Goffstown Nh Tax Rate goffstown, nh 03045. For tax exemption & credits information please visit the assessing page. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. the. Goffstown Nh Tax Rate.

From nhfpi.org

Ten Facts About the New Hampshire State Budget New Hampshire Fiscal Policy Institute Goffstown Nh Tax Rate The higher the property tax rate means it’s more expensive to live in that town because property taxes are. The first tax bill is mailed at the end of may or early june and is due 30 days. the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. . Goffstown Nh Tax Rate.

From nhfpi.org

Report Shows Higher Effective Tax Rates for Residents with Low New Hampshire Fiscal Goffstown Nh Tax Rate property tax exemptions & credits. the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. the average property tax rate in new hampshire is 19.27. The higher the property tax rate means it’s more expensive to live in that town because property taxes are. For tax exemption. Goffstown Nh Tax Rate.

From nhfpi.org

An Overview of New Hampshire’s Tax System New Hampshire Fiscal Policy Institute Goffstown Nh Tax Rate For tax exemption & credits information please visit the assessing page. The first tax bill is mailed at the end of may or early june and is due 30 days. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. the average property tax rate in new. Goffstown Nh Tax Rate.

From manchesterinklink.com

Goffstown tax rate expected to stay level Manchester Ink Link Goffstown Nh Tax Rate The first tax bill is mailed at the end of may or early june and is due 30 days. For tax exemption & credits information please visit the assessing page. the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. the 2023 census estimate for goffstown was 18,529. Goffstown Nh Tax Rate.

From us.icalculator.com

New Hampshire State Tax Tables 2023 US iCalculator™ Goffstown Nh Tax Rate For tax exemption & credits information please visit the assessing page. The higher the property tax rate means it’s more expensive to live in that town because property taxes are. the average property tax rate in new hampshire is 19.27. before the second installment property tax bill is mailed, the department of revenue administration must set the tax. Goffstown Nh Tax Rate.

From www.city-data.com

Goffstown, New Hampshire (NH) map, earnings map, and wages data Goffstown Nh Tax Rate the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. For tax exemption & credits information please visit the assessing page. goffstown, nh 03045. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. the. Goffstown Nh Tax Rate.

From www.city-data.com

Goffstown, NH Town Hall photo, picture, image (New Hampshire) at Goffstown Nh Tax Rate The first tax bill is mailed at the end of may or early june and is due 30 days. the 2023 census estimate for goffstown was 18,529 residents, which ranked 14th among new hampshire's incorporated cities and. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the.. Goffstown Nh Tax Rate.

From www.snhpc.org

Economic Development SNHPC Goffstown Nh Tax Rate goffstown, nh 03045. property tax exemptions & credits. The first tax bill is mailed at the end of may or early june and is due 30 days. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. the average property tax rate in new hampshire. Goffstown Nh Tax Rate.

From ceupgijk.blob.core.windows.net

New Hampshire Property Tax Rates 2020 at Maud Keen blog Goffstown Nh Tax Rate before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. The higher the property tax rate means it’s more expensive to live in that town because property taxes are. the 2023 census estimate for goffstown was 18,529 residents, which ranked 14th among new hampshire's incorporated cities and.. Goffstown Nh Tax Rate.

From www.loopnet.com

553 Mast Rd, Goffstown, NH 03045 Goffstown Plaza Goffstown Nh Tax Rate before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. The higher the property tax rate means it’s more expensive to live in that town because property taxes are. the average property tax rate in new hampshire is 19.27. the tax collector’s office is responsible for. Goffstown Nh Tax Rate.

From ceupgijk.blob.core.windows.net

New Hampshire Property Tax Rates 2020 at Maud Keen blog Goffstown Nh Tax Rate property tax exemptions & credits. The first tax bill is mailed at the end of may or early june and is due 30 days. the average property tax rate in new hampshire is 19.27. The higher the property tax rate means it’s more expensive to live in that town because property taxes are. the 2023 census estimate. Goffstown Nh Tax Rate.

From nhfpi.org

An Overview of New Hampshire’s Tax System New Hampshire Fiscal Policy Institute Goffstown Nh Tax Rate For tax exemption & credits information please visit the assessing page. goffstown, nh 03045. The first tax bill is mailed at the end of may or early june and is due 30 days. The higher the property tax rate means it’s more expensive to live in that town because property taxes are. the average property tax rate in. Goffstown Nh Tax Rate.

From scholars.unh.edu

"Annual reports of the selectmen and treasurer of the town of Goffstown" by Goffstown Town Goffstown Nh Tax Rate property tax exemptions & credits. the tax collector’s office is responsible for collecting warranted tax revenue for property tax, timber tax, current use, excavation tax,. goffstown, nh 03045. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. the 2023 census estimate for goffstown. Goffstown Nh Tax Rate.

From www.eagletribune.com

New Hampshire tax rates set throughout region New Hampshire Goffstown Nh Tax Rate property tax exemptions & credits. the 2023 census estimate for goffstown was 18,529 residents, which ranked 14th among new hampshire's incorporated cities and. before the second installment property tax bill is mailed, the department of revenue administration must set the tax rate for the. the average property tax rate in new hampshire is 19.27. The first. Goffstown Nh Tax Rate.